If you are like me, in this bear market, your portfolio could use a little less volatility. Okay, a lot less. With that in mind, you might like to hear about how you can still earn more pay days and sleep well at night. The opportunity I'm going to share with you today is a little different; it isn't stocks, bonds, or crypto, and it isn't exactly real estate either. But what it offers are frequent payouts, it is IRA approved, it offers automatic reinvesting (which makes compounding work for you), and it has low minimums to get started - only $10! Intrigued? I hope so, because I'm pretty excited about what I've discovered, and I can’t wait to share it with you.

Hi, I’m Don Smith, author of my newly launched newsletter on Substack, aptly named Pay Days! Please subscribe to get regular ideas and updates on how to create more pay days in your own life. Read all the way to the end to find out how you can get $100 when you try out Groundfloor for yourself.

Now let's get into it - as you may know, we're building a diversified portfolio of consistent pay days. Over time, we're going to be able to replace our bi-weekly salary pay days with enough other pay days to no longer be so dependent on the salary. And this article is about yet another way to make this dream a reality.

The opportunity today is called Groundfloor, and it is a simple concept. They make construction loans, and their platform makes it easy for us to participate in those loans, with just a minimum investment of $10! That's right, it's that easy to get started!

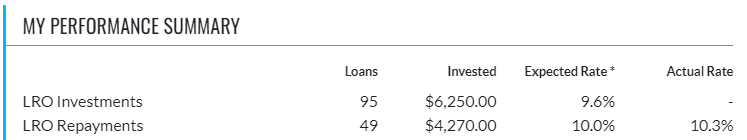

I started with $100 and spread it out over ten loans. I was so pleased with the results I added another $1000 to my account. Again, the results blew me away, so I added another $5k to my investment accounts with Groundfloor. Here's a recent snapshot my Groundfloor portfolio:

With Groundfloor, we're getting consistent (if not regular) pay days. Each time a loan is repaid, and these are short term loans, we get our capital back, plus interest. And as you can see, in my 2-year trial, I've earned 10.3% return.

Where else can you get that kind of return and low volatility? Seriously, I'd like to know. I can't think of any.

I remember when I was really young, my grandfather opened up savings accounts for all his grandkids at the local credit union. If I recall, the interest rate was about 6%. Can you imagine a savings account paying 6%!? Some years later, when the credit union rates had dropped to 2%, there was a business development company in town offering 12% interest rates! But they didn't survive long. Business is hard, but it's really hard in a small town.

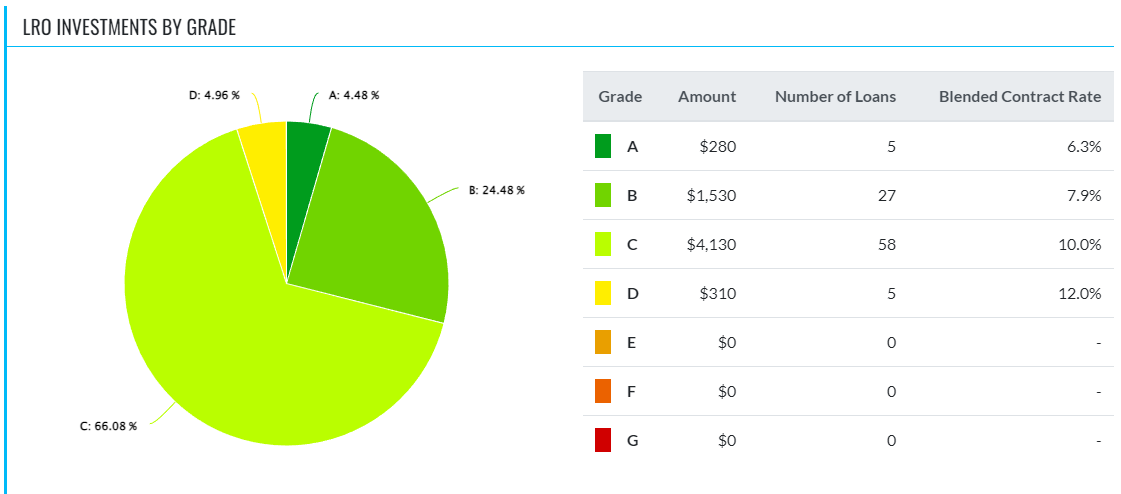

Groundfloor is different, they offer short term construction loans in most states in the USA. This gives them the ability to be regionally diversified. On top of that, they offer different kinds of construction loans - product diversity. What this translates into for us as investors is an opportunity to pick your risk tolerance, set a budget and build a portfolio of loans with a target return that should be very stable. Here is my is a recent view of my portfolio of loans:

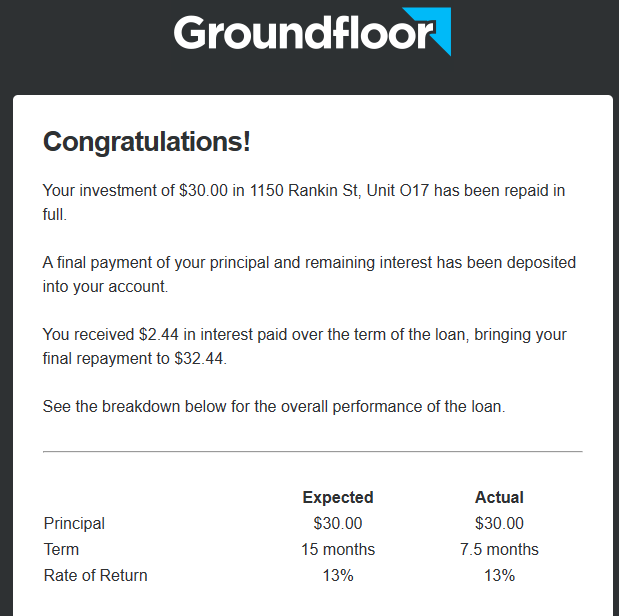

One of my biggest surprises was to realize how much fun the Groundfloor platform is. For example, because I’ve been investing in loans for a while now, I get several emails like this each week (these are real screenshots of my emails):

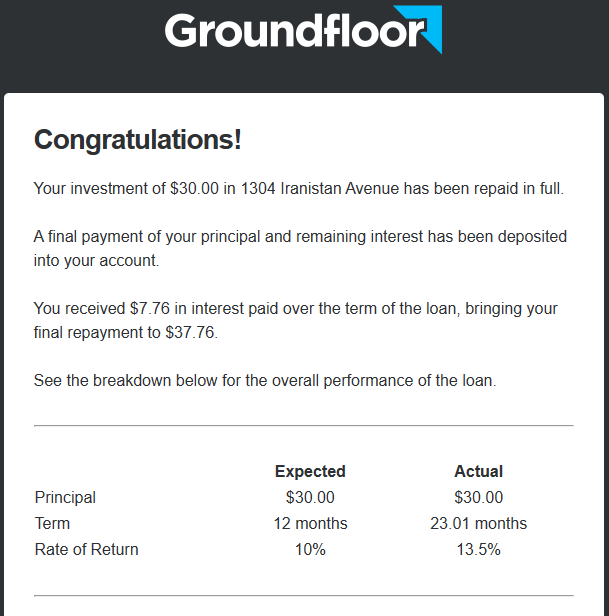

Notice that loan was paid back early, and I still made $13%. Or this one out:

Unfortunately, this loan went longer than expected, but I earned more interest than expected, so I’m not complaining.

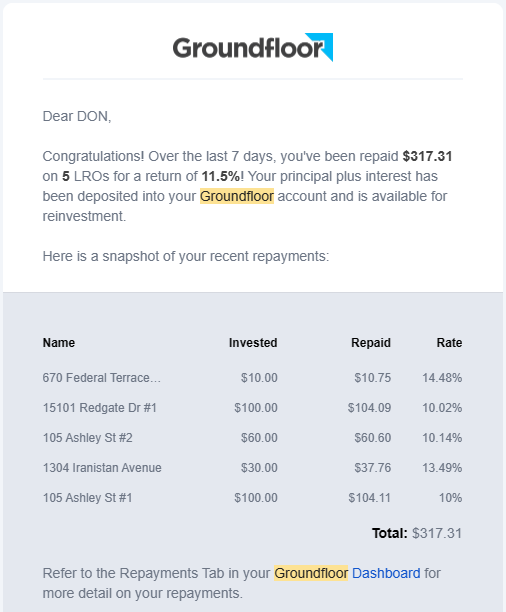

Groundfloor sends out a weekly recap, too:

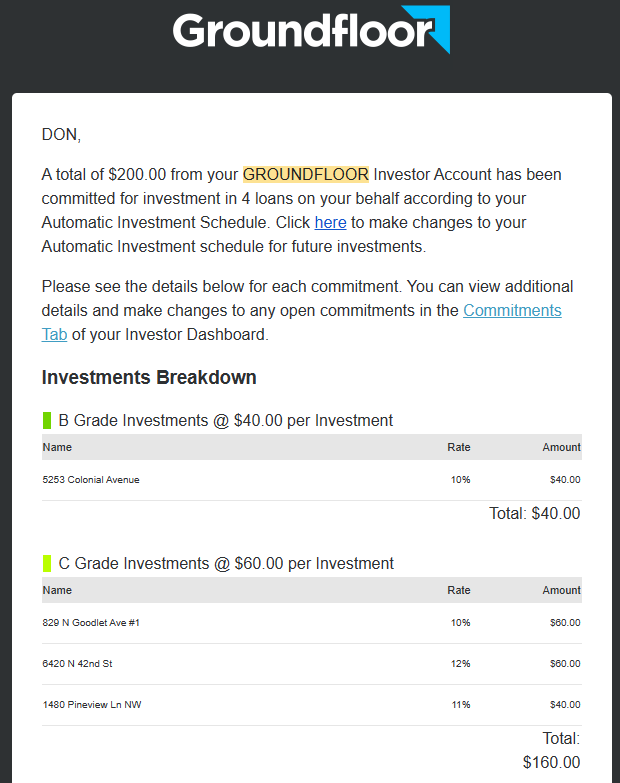

Finally, since I use the auto reinvesting tool, I get regular emails like this one:

Isn’t that cool? My money is on autopilot with Groundfloor. Unlike a dividend paying stock that only pays out 4 times a year, at this point Groundfloor is generating multiple pay days each week! More pay days equals more fun!

Now, what are the downsides? Well, I have come up with a couple I think are worth mentioning. The first is that, as I hinted earlier, these aren't predictable pay days. Some loans go to term before they are paid back, some go long, but I've noticed a lot get paid back early (which is awesome!) The second downside is that there is no opportunity for capital appreciation. But that's what makes this a low volatility investment, unlike a stock or even a high-yield bond. I'm comfortable with those cons because I'm using Groundfloor as a tool to smooth out my overall portfolio volatility and still generate consistent pay days.

But before I wrap this up, and at the risk of sounding like a shill, I'm very impressed with the tools Groundfloor provides investors. They are very transparent about the loans: they show you which properties you're funding, the state of the loans as time progresses, and the engagement with the borrowers to bring loans back into compliance if they struggle. I think it's way beyond necessary for me as an investor, but it does instill a confidence in their business that I suppose I wouldn't have otherwise.

Let's recap - Groundfloor offers pay days with

Less volatility

Frequent pay days - return of principle plus interest

Automatic reinvesting/compounding (It's like autopilot for your account!)

IRA approved.

Good website tools

Low minimums - only $10

And, right now, during the month of May 2023, Groundfloor is offering $100 to each new investor to try them. Deposit $1000 into your investor account to qualify for the $100 bonus. Just use my referral link (full disclosure I'll also get $100 - more pay days for all!) to sign up: Groundfloor Sign Up Link

If you give Groundfloor a try, I’d love to hear what you think, too. Please post comments here for all of us to learn together.